Man Shares His Concern on Budget 2025 and Its Effects on Malaysia’s Economy

Byline: Qadeem Zieman

I had recently come across a forwarded appeal letter regarding the banking system in Malaysia. The concern sparked as it had come to the attention that there are number of promising clients who are potentially keen to invest large sums of money, but were unfortunately found stuck due to the issues involving the ‘Red Tape’.

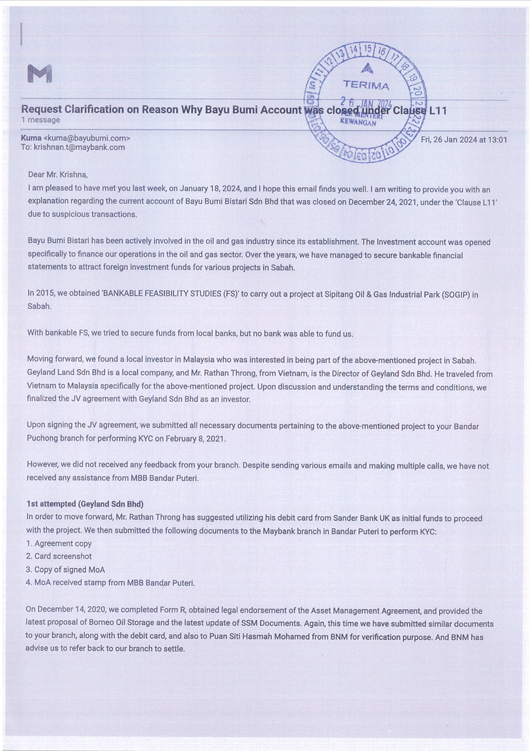

Thiagarajan Suppiah, the Managing Director of Bayu Bumi Bestari (S) Sdn Bhd, voiced his dissatisfaction over this matter which has been found to be quite worrying and could land a negative impact on Malaysia’s economy in a letter subjected ‘BUDGET 2025: CALL TO BANKS TO SUPPORT AND INCREASE INVESTMENT IN MALAYSIA’.

It is agreeable that our Prime Minister, Dato’ Seri Anwar Ibrahim deserves recognition for his efforts to attract billions of ringgits in investment following his visit abroad. Potential investors are becoming interested in the tax breaks promised in Budget 2025. Unfortunately, Malaysian businesspeople who are seeking opportunity to invest billions in the country face obstacles due to bank regulations (red tape)

AMLA Police Unit has done a good job in their ongoing efforts to arrest foreign and domestic money launderers in the country. However, due to this circumstance, banks have terminated and frozen the accounts of real investors without question, causing limits and difficulties. In accordance to The Financial Services Act 2013, banks do not require the bank to disclose a reason for terminating the account. Due to this predicament, both foreign and local investors who were drawn to Malaysia by Dato’ Seri Anwar Ibrahim’s appeal during his foreign visit are unable to move forward with multibillion dollar projects. It is regrettable that barriers exist in the investment entry procedure despite YAB's best efforts to draw in capital.

It is suggested that ‘Budget 2025’ should be accompanied by the establishment of a special team in order to ensure swift and transparent approval for investment into Malaysia, and at the same time to address the incentives offered by neighbouring countries which are sometimes better to attract foreign investors. Apart from that, as the finance minister, our Prime Minister should also call up the authorities to investigate the reasons for delays, account closures and account freezes that has been preventing investments from entering the country.

The latest announcement made by the Prime Minister concerning the delay in recovering embezzled corruption funds is affecting the hard work to improve the country's economy.

Enhancing the economy is crucial, and the Ministry of Finance should work resolutely to limit the amount of legitimate investment that enters the nation and cut down on the bureaucratic red tape of the large, unregulated banks. The transparency protocol of banking activities needs to be strengthened and re-examined by Bank Negara and the National Audit Department.

The big planned projects cannot be carried out by investors who have been trapped with billions of investment cash in Malaysian banks for years. Due to this, participation in initiatives that support the growth of the Malaysian economy has been delayed. Authorities including the Attorney General's Office, the Ministry, and the National Bank have all written banks pleading with them to reopen these frozen accounts for domestic investment objectives. Banks have refused to comply.

Regulatory and oversight organisations such AMLA, the Attorney General's Office, Bank Negara Malaysia, and the Deputy Prime Minister's Office have made multiple unsuccessful attempts to get an explanation from these banks. Investors are experiencing inconvenience and worry as a result of financial institutions' continued hesitation and disregard for requests to reopen impacted accounts. Due to this, investors have relocated their interests to Vietnam, Thailand, and Indonesia. Bank closures and delays did not contribute to the country's economic recovery, despite the government's aggressive efforts to overhaul the financial system. The extensive and unchecked discretionary powers that banks and other financial institutions wield have given rise to concerns. This matter is undeniably a strong signal for the 2025 Budget to give faster approval and the need for enhanced oversight as well as a sense of accountability by the Ministry of Finance.

It is urgently requested that the government form a special task force headed by AMLA and the Law Enforcement Agency to investigate the growing number of widespread occurrences of account termination. The task force should be established as soon as possible. With all due respect, we request that YAB Prime Minister, Dato’ Seri Anwar Ibrahim and government representatives expedite the flow of investment capital into Malaysia.

“As a society, it is paramount to acknowledge the profound implications stemming from the absence of economic awareness among specific demographics, notably the youth. The inadequate comprehension of economic principles, particularly prevalent among the younger generation, exposes individuals to the threat of falling prey to diverse forms of financial malfeasance, including white-collar crimes permeating the banking sector.

White-collar crimes, encompassing deceit, misappropriation, and illicit financial transactions, not only engender harm to the immediate victims but also trigger far-reaching repercussions for the economy and society on a broader scale. These illicit activities corrode trust in financial institutions, unsettle market equilibrium, and culminate in substantial financial losses for individuals, enterprises, and even governmental entities.

Furthermore, the upsurge in financial impropriety within banking establishments can subvert the integrity of the entire financial framework, jeopardizing the overall economic welfare of a nation. Consequently, it becomes imperative for all stakeholders, be it educators, policymakers, or financial institutions, to confront the deficiency in economic literacy among the youth and foster a culture of cognizance and accountability to fortify defences against potential financial transgressions.” – said Thiagarajan Suppiah.